One-stop compliance solution for crypto business

The AML Check platform automates AML / KYC procedures and reduces compliance expenses

What our clients say

-

INATBA

INATBA

-

CDA

CDA

-

ATII

ATII

-

LSW3

LSW3

-

ЕВА

ЕВА

-

FTAHK

FTAHK

Our 300+ clients and partners

"AML Compliance and Risk Detection"

+$100 000 000

Amount of the risky funds detected

Compliance departments that accept our AML procedures

60,000+

Service providers checked

AMLBot's services

We provide full pack of options for safe work with crypto

AML/KYT screening

API solutions that empower AML compliance tools within your current system. All transactions are automatically verified to comply with AML and FATF requirements and reduce your business risk exposure.

KYC for business

The streamlined and automated verification process empowers your business to swiftly onboard customers, reducing manual effort and mitigating identity fraud and illicit activity risks.

AML/KYC procedures

Launch your crypto venture with ease, simplicity, and confidence through our streamlined AML and KYC consulting, ensuring smooth compliance and effective risk management right from the beginning.

Corporate accounts at CEX/EMI

Streamline corporate account opening on CEX EMI with our expert assistance, ensuring your focus remains on business growth in the crypto industry.

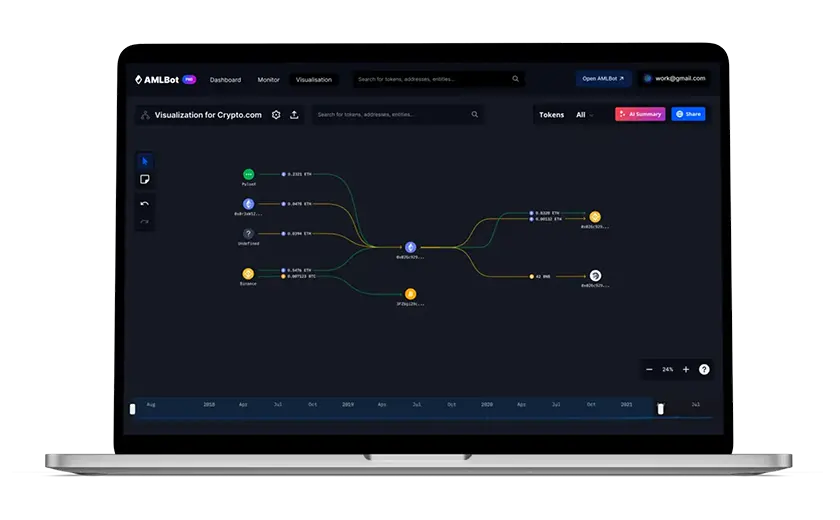

Blockchain investigations

Recover stolen cryptocurrencies with AMLBot's expert blockchain investigations, swiftly identifying culprits and tracing funds for effective recovery.

ISO certified

We continually improve our security measures to uphold trust and safety. Learn more about our certifications

How much for your assurance?

From

Spending a few dollars on a check may save you a large sum.

Why AMLBot?

Personalized Approach

- AMLBot offers a wide range of compliance solutions customized for each client.

- We're confident in meeting your demands after helping 300+ crypto enterprises of all sizes in 25 jurisdictions.

Integrated Compliance Platform

- We offer KYT/Wallet Screening, KYC, AML, and more for crypto businesses.

- AMLBot' risk scoring is based on multiple data sources, ensuring that we have the most reliable data in the industry.

- Our user-friendly services and solutions streamline your company processes, removing compliance provider complexity.

Customer Support

AMLBot understands the significance of fast, friendly customer support, thus we're always here for our clients. 24/7 support.

An answer during the night may take a bit longer

Meet the core team

Slava Demchuk

Sid Panda

Graeme Hampton

Anmol Jain

FAQs

Is your question not on the list?

Contact us via messenger. We are in touch 24/7, so any issue can be resolved quickly and in a live chat format.

It may take a little longer to respond during the night.

In addition, the check result may include various optional information about the address, such as belonging to the cluster, actual balance, and transferred funds amount.

The check result may be incomplete in relation to the described data if the necessary information is missing.

Please note that for blockchains that are in the limited mode, clustering and percentage value of the check risk score are not available. A risk score can be provided for a counterparty only if it relates to an entity.

AMLBot finds connections of a checked address to other addresses on the blockchain and with entities of different categories, each with a different conditional risk score, and calculates the overall risk score based on those connections.

The overall risk score calculation takes into account the risk severity of connections found. For example, in the case of connections to entity categories Mining (0% risk) and Darknet (100% risk), the risk impact of Darknet, as a more risky category, will be higher, and Mining will have less weight in the risk assessment.

The AML check shows the connections of the checked address to these entity categories as the sources of risk, with which the address interacted, and the percentage of funds transferred from/to these services.

Based on all the sources of risk, an overall risk score is calculated, which helps the user to make further decisions about the assets.

A transaction check process differs from the address check, and the result depends on your side in the transaction. The overall risk score always relates to the counterparty.

To check a transaction you need to specify the TxID and the destination address of the transaction and select your side in the transaction:

- Recipient (you got a deposit to your wallet) - the addresses from which the funds were received are checked. The sources of risk describe the services from which the TX senders accumulated the transferred funds with a percentage breakdown.

- Sender (you made a withdrawal from your wallet) - the wallet that received the funds is checked. The sources of risk describe all connections of the recipient address with a percentage breakdown.

Thus, when checking a transaction, the risks for the recipient are checked if you receive funds, and the risks for the sender if you send funds.

- 0-25% is a clean wallet/transaction;

- 25-75% is the average level of risk;

- 75%+ such a wallet/transaction is considered risky.

It is also worth paying attention to the red sources of risk in the detailed analysis

If the check shows that your assets had no connection with illegal activity and the service blocked you, you can provide the saved result to confirm the purity of your assets.

• up to 10 minutes if the payment was made within 24 hours after the invoice was issued,

• up to 25 minutes if the payment was made after 24 hours after the invoice issuance. Overall, BTC, ETH, USDT, and fiat are processed faster than other cryptocurrencies.

If you purchased checks with a time limit - they will be deducted from your account after expiration date.

Our ISO 9001 certification highlights our commitment to delivering consistent quality and enhancing customer satisfaction. More crucially, our ISO 27001 certification demonstrates our dedication to maintaining high standards of information security, ensuring the protection of sensitive data, and achieving regulatory compliance.

Learn more about our certifications here.